Posted by Wayne, December 11, 2025.

If you own a business, you'll know that cashflow planning isn’t just about surviving the end of the year, it’s about setting the rock-solid financial foundation for a successful new year ahead.

In this article is by Wayne Lock, owner of Achieve Business & Financial Solutions, provides advice on how to avoid the often hectic end-of-year financial rush.

It’s easy to get caught up in the year-end rush, but strategic cash flow management is the single most effective way to prevent financial pitfalls, grow and transition into the new year with power and control.

Good cashflow planning helps you stay in control, anticipate problems and make data-driven decisions rather than reacting to crises.

A tailored strategy helps you:

- Stay Ahead of Cash Gaps: By modelling future inflows and outflows you never get caught out, especially with seasonal troughs or large irregular expenses.

- Make Confident Decisions: Knowing your exact cash position makes it easier to green light decisions on expansion, capital investment or cost cutting before you run out of resources.

- Maximise Profitability (Not Just Sales): Cashflow planning shines a light on the timing of money, your current payment terms or inventory cycles are costing you.

Your 7-Step Cashflow Strategy Checklist

Use these seven steps to move beyond basic budgeting and establish a financial roadmap that gives you control and predictability in the year ahead.

1. Consult Your Experts: Accountant and Financial Advisor

Your end-of-year review is a strategic postmortem. Get proactive advice.

- Action Mandate: Schedule a Quarterly Strategic Review Meeting focused purely on the year ahead.

- Discuss Tax Strategy: Should you increase depreciation, adjust PAYG instalments or change your entity structure? Your accountant’s advice here will impact your available cash.

- Key Metric to Review: Quick Ratio (or Acid-Test Ratio). This measures your ability to cover short-term liabilities with your most liquid assets. Aim for a minimum of 1.

2. Dive into Revenue and Expense Cycles

Don’t just look at totals. Analyse the timing and frequency of every dollar.

- Action Mandate: Break revenue down by payment terms (Net 7, 14, or 30 days) and expenses into fixed vs. variable costs.

- Optimise Cash: Review your Accounts Receivable (AR) and Accounts Payable (AP). Can you offer early payment discounts to customers? Are you maximising the payment terms with suppliers without accruing fees?

- Key Metric: Days Sales Outstanding (DSO). How long do you take to collect cash from sales? Lower is better.

3. Benchmark Yourself

Are you keeping up with the industry? Compare your business to similar operators in Australia.

- Action Mandate: Find your industry’s key financial benchmarks and compare yourself.

- Inventory Check: If your Inventory Turnover Ratio is low, cash is tied up in stock that’s not moving.

- Service Check: For service businesses, check your Gross Profit Margin. If it’s too low, pricing or labour costs need to be adjusted.

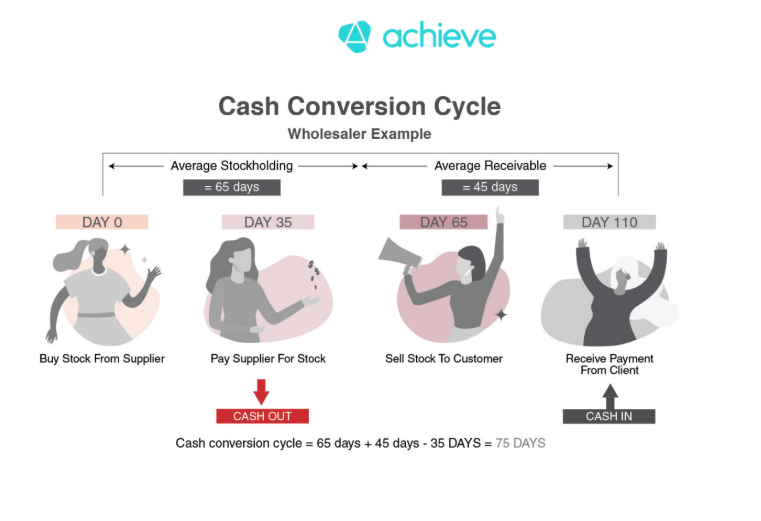

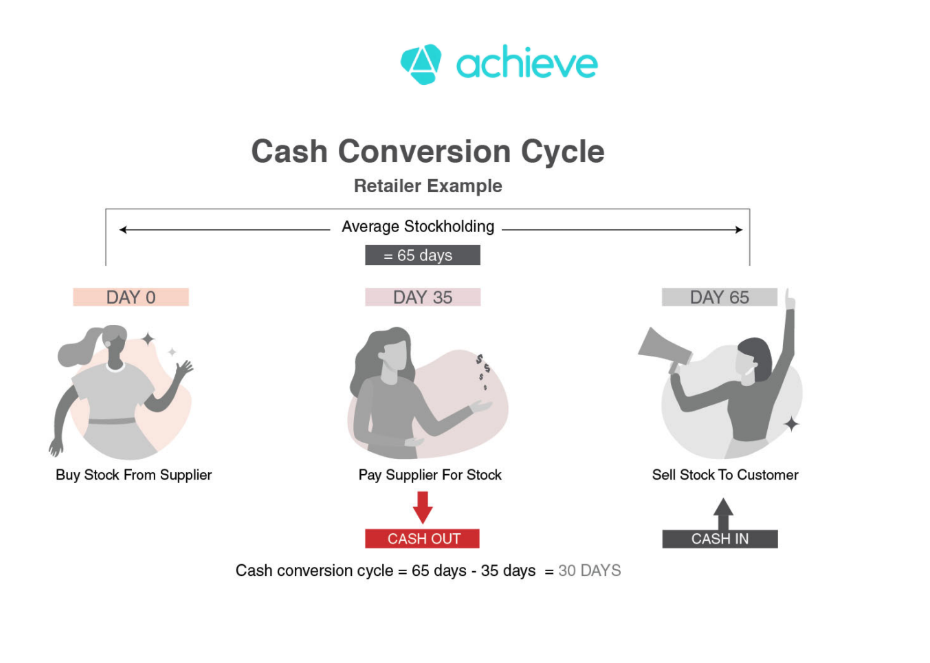

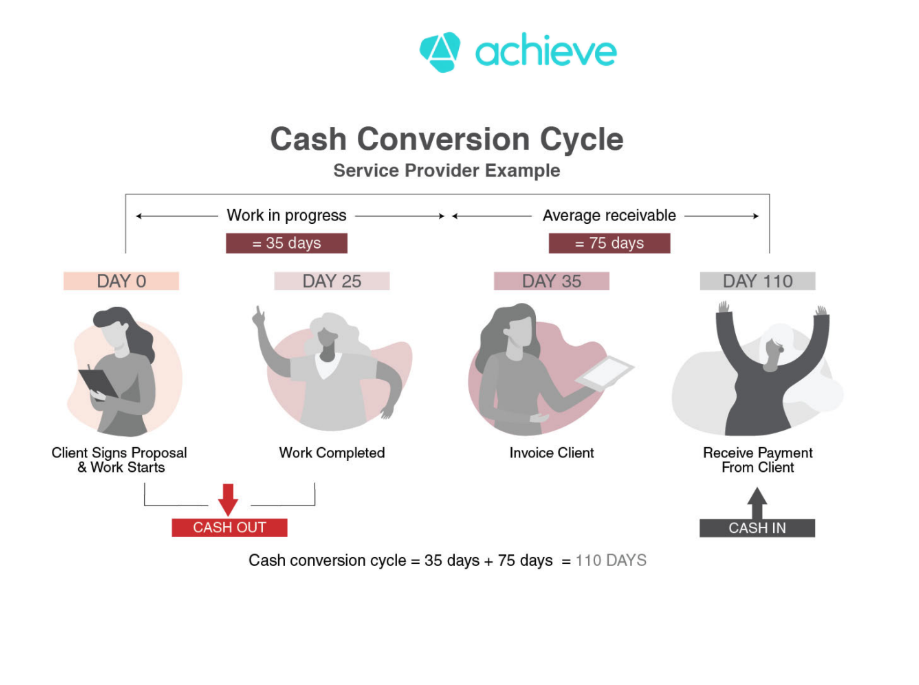

- Key Efficiency Metric: Cash Conversion Cycle (CCC). This measures the days it takes for your investment in resources to turn back into cash flow from sales. Lower is better.

4. Stress Test Payroll and Tax

These are non-negotiable costs. Plan for them with precision to avoid surprises.

- Action Mandate: Set up a separate, dedicated savings account for major liabilities like quarterly GST, estimated income tax (PAYG instalments), and superannuation.

- Growth Modelling: Model the full cash impact of planned staff growth or pay increases 6-12 months out. Remember superannuation, PAYG withholding etc.

- Key Metric: Operating Cash Flow (OCF) Margin. What percentage of your revenue is left after operating costs? It needs to be healthy enough to cover debt and taxes.

5. Create a Live 12-Month Cashflow Forecast

This is your predictive tool, not just a budget. Update it monthly.

- Action Mandate: Develop a rolling 12-month forecast for best case, worst case and most likely scenarios.

- Scenario Planning: Model potential disruptions. What if a major customer pays late? What if utility costs surge? This will highlight your cash crunch points.

- Australian Resource: Business.gov.au has guidance and tools for planning: Guide to managing cash flow

6. Game Plan for Success

Your cash flow plan is the roadmap to your business goals.

- Action Mandate: Link specific cash surpluses (or funding) to measurable goals.

- Capex Timing: If you need new equipment (Capital Expenditure), buy it after a period of high revenue inflow to minimize stress on your operating cash.

- Cash Reserve: Set a formal Cash Reserve Target (e.g., 3-6 months of operating expenses) and track it.

7. Implement and Review

A plan must be a live tool. Review Actuals vs. Forecast regularly.

- Action Mandate: Schedule time at the start of every month for financial review.

- Be Proactive: If cash is below forecast, you need to act now—chase receivables or delay non-essential payments. If it’s above forecast, consider strategic investments or debt reduction.

- Frequency is Key: Cashflow needs a monthly check-up, not quarterly.

Examples of Typical Cash Conversion Cycles in Business

1. Wholesaler

2. Retailer

3. Service Provider

Ready to set your business up for success?

While creating a cash flow strategy can seem daunting, you don’t have to do it alone. At Achieve, we can help you develop a custom cash flow strategy that aligns with your business goals.

Our team is here to help you get set for the year.

Contact us today for a free consultation: https://calendly.com/wayne-lock/cashflow_consultation

See also: Business Consulting